Covered calls are a form of options trading popular among investors in the United Kingdom. A covered call allows an investor to buy shares at a specified price and then sell call options at a higher price, which can generate additional income. This strategy can be used by traders in any market but is especially useful for those looking to capitalise on the strong UK economy.

How covered calls work

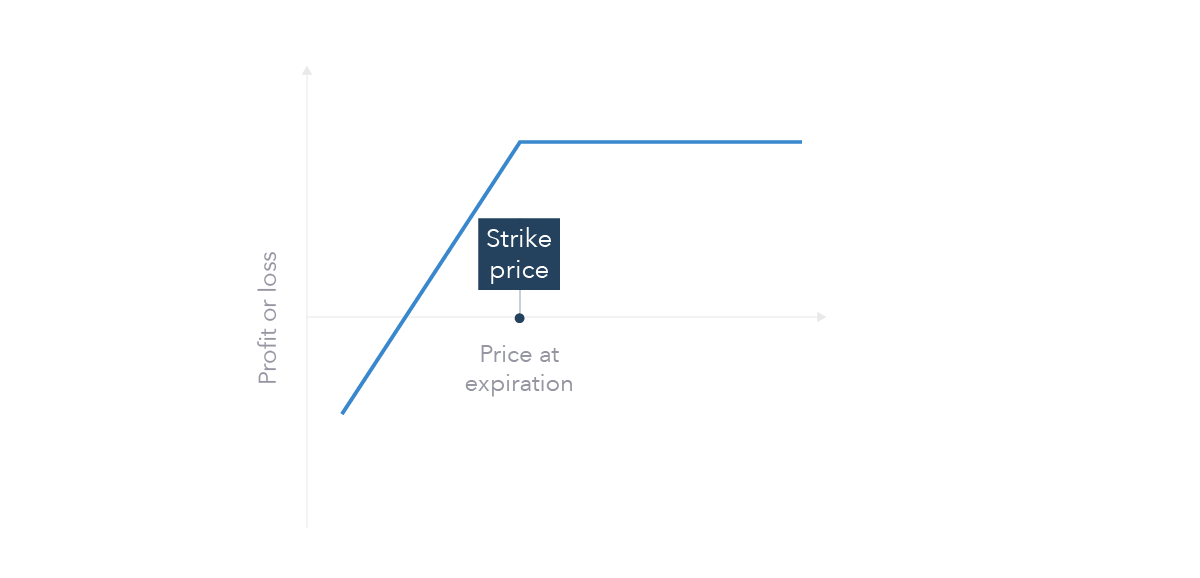

Investors will purchase the underlying stock or ETF when engaging in covered calls if they wish to have exposure. Once this has been accomplished, the investor must decide what strike price they would like to use. When exercising an option contract, the strike price represents how much someone would pay for shares. Investors typically try to select a strike price slightly higher than their purchase price to generate income when the option is exercised.

After selecting a strike price, the investor must choose an expiration date for the options contract, which should be calculated based on how long the investor wants to maintain control over their shares and how much time they want to allow for potential stock appreciation. If the stock’s price increases beyond the strike price before expiration, investors can still benefit from a profit as long as they have not sold their shares before expiry.

Investors must execute these trades through an online broker or financial advisor to benefit from covered calls and ensure that all parties involved are protected. These services provide traders with access to research tools and real-time market data. They also have access to a wide range of options contracts that traders can use for the covered call strategy. Using these services, investors can gain exposure to markets without having to open and fund an account with a broker or exchange.

What are the risks of using covered calls?

Covered calls are a relatively simple and low-risk way for investors to generate additional income from their holdings in the UK market. However, the risks of using covered calls should be addressed, as they could lead to losses and missed opportunities if traders are not careful. One of the most crucial risks associated with this strategy is the potential for the underlying stock or ETF to increase in price beyond the strike price before the expiration. If this occurs, the investor will lose out on potential profits as their option contract will remain unexercised.

Another risk of using covered calls is the cost associated with commissions and fees charged by brokers. These fees can add up quickly, primarily if an investor engages in frequent trading. Additionally, some markets may lack liquidity, making it difficult to find buyers for options contracts at desired prices.

Finally, investors must consider market volatility when using covered calls, as sudden price changes can rapidly affect the value of their investments, making it difficult to accurately assess how much money can be made or lost through listed options trading. Investors must also remember that options expire and must physically exercise them before their expiration date to benefit from any profits earned through this strategy. By understanding all the risks and rewards associated with covered calls, investors can make better decisions when trading in the UK market.

The bottom line

The United Kingdom’s strong economy and diverse markets provide ideal opportunities for investors looking to use covered call strategies to generate additional income. This strategy is suitable for short-term traders and long-term investors seeking to benefit from stock appreciation over time.

By taking advantage of rising share prices, traders can generate a steady income through option premiums while maintaining control of their underlying shares until expiry. However, it is essential to understand the risks involved before engaging in this strategy and always seek professional investment advice before making any significant trades. With a thorough understanding of the risks and rewards associated with covered calls, investors can benefit from this strategy in the United Kingdom while minimising potential losses.